Navigating HOA Budgets in Florida: Best Practices and How a Management Company Can Help

- José R. Hernández

- Dec 7, 2023

- 3 min read

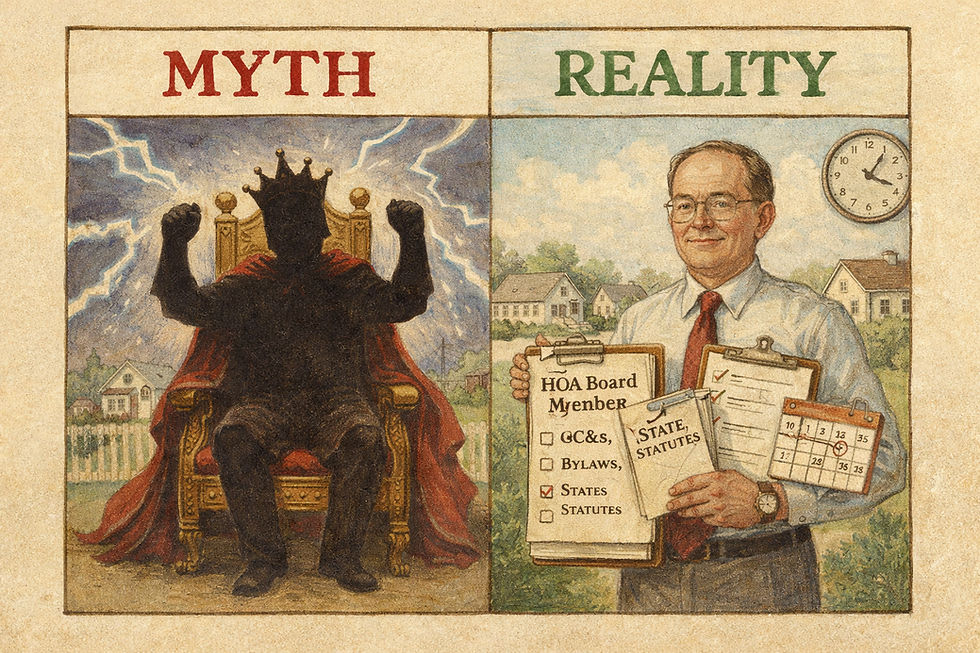

Homeowner Associations (HOAs) in Florida face a unique set of challenges when it comes to budgeting. The responsibility to manage, allocate, and balance the finances of an entire community can be daunting, often met with unforeseen obstacles and complex decision-making. This article delves into Florida's best practices for HOA budgeting, understanding the various requirements and approval processes, and how an HOA management company can turn these challenges into opportunities.

Best Practices for HOA Budgeting in Florida

Following best practices for HOA budgeting in Florida can simplify this complex process. This includes realistic forecasting of income and expenses, separating operating and reserve funds, and planning for unexpected costs. Regular reviews and adjustments to the budget are also essential to ensure that the community's financial health remains robust and resilient.

Understanding Florida's HOA Budgeting Requirements

Florida has stringent statutory requirements for HOA budgets to ensure financial transparency and stability in residential communities. These include clear and detailed disclosure of all anticipated revenues and expenditures and mandatory notification of budget meetings to all members. Understanding and abiding by these stipulations is crucial for maintaining good standing and fostering trust within your community.

The Approval Process for HOA Budgets in Florida

The budget approval process in Florida's HOAs is a systematic and transparent one. It requires careful planning and adherence to specific procedures and deadlines. A smooth and successful approval process involves active member involvement, comprehensive budget presentations, and prompt responses to member inquiries.

Important Deadlines in the HOA Budget Approval Process

Adherence to deadlines is especially crucial in the process of HOA budget approval in Florida. Here are some key dates that HOA boards need to keep in mind:

Budget preparation: The preliminary budget should be prepared and ready for review at least 90 days before the fiscal year-end. This allows enough time for board review and necessary adjustments.

Notification of budget meeting: Florida Statutes require that the board notify all members of the date, time, and place of the budget meeting at least 14 days in advance. This notification should be posted in a conspicuous place in the community and mailed or delivered to each owner.

Budget meeting: The meeting should occur at least 60-90 days before the start of the fiscal year. The proposed budget is presented to the community during this meeting for approval.

Budget adjustments: Following approval, the board should review the budget quarterly or as needed and make any necessary adjustments. Significant changes require notification and approval by the community.

Remember, adhering to these deadlines is a legal requirement and critical for the smooth operation of the HOA's financial management.

Overcoming Budgeting Challenges: Role of an HOA Management Company

However, managing an HOA budget can be overwhelming for board members, who often volunteer their time. This is where an HOA management company can step in to alleviate these challenges. They offer specific services such as financial reporting, dues collection, and budget preparation, which ensures professional handling of your community’s finances and frees up valuable time for board members.

Benefits of Hiring an HOA Management Company

The benefits of hiring a professional HOA management company are multifold. They bring expertise and efficiency to the table, improving the community's financial health. They also ensure compliance with Florida's stringent budgeting requirements, thus avoiding potential legal pitfalls.

In conclusion, understanding and managing an HOA Budget in Florida can be complex, but with the right practices and professional help, it can be navigated successfully. As a board member, considering professional help from an HOA management company may be an effective solution to your community's financial management needs.

Don't hesitate to contact us for more information or a consultation regarding your HOA’s budgeting process. We are here to help. Please also consider sharing this article with others who might find it helpful.

Did I miss anything? Please let me know in the comments! Also, please subscribe to our blog to receive a notification when new articles arrive.

At Don Asher Management, we've proudly served the Central Florida community for over 70 years. As a locally-owned company with a strong understanding of the local market, we've cultivated substantial relationships with local and national contractors to provide top-quality services. We're dedicated to meeting your Property and HOA management needs with a personalized touch, combining our decades of experience and commitment to detail for unmatched service. We're confident in our ability to deliver exceptional services tailored just for you. Choose Don Asher Management - where personalized attention meets professional service.

Comments